Using Different Tax Rates

It is possible to localize your Invoices for Clients from different countries by translating the invoices into their language, setting the appropriate currency and using tax rates applied in a particular country.

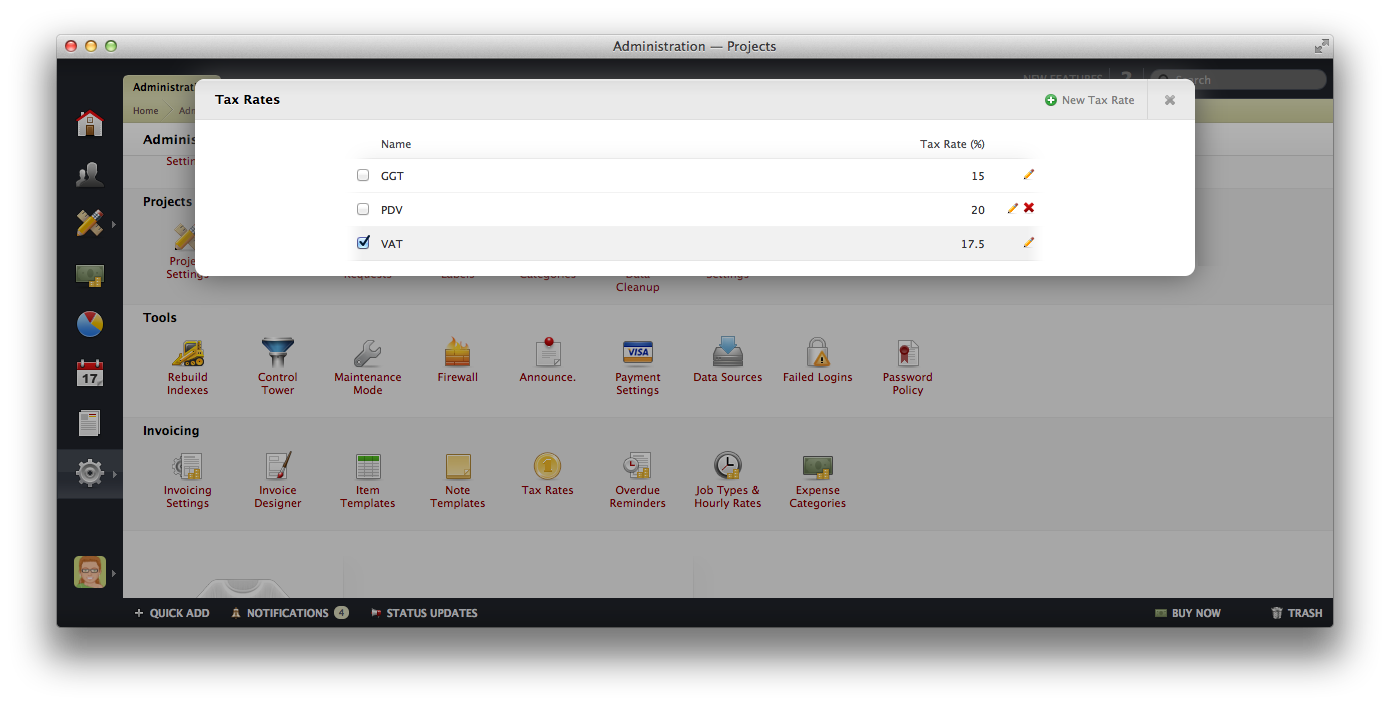

You can set as many different Tax Rates as you wish and use them when needed. Open Administration > Tax Rates and use the New Tax Rate button.

All the available tax rates will be listed on this page. Select the tax rate that you wish to use as default:

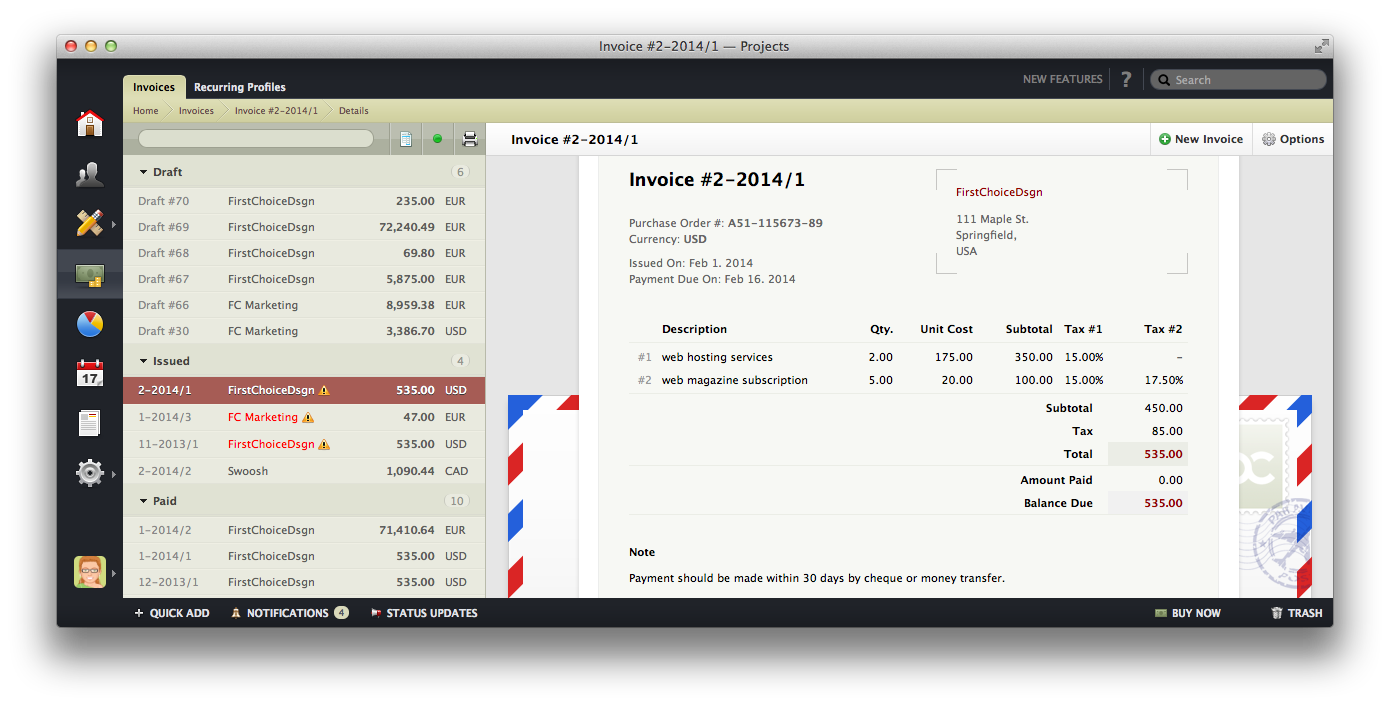

On top of that, you can choose how to display taxes on the Invoice - either as rates or as amounts. You can choose one of these options in Administration > Invoice Designer by opening Body Settings and selecting how to display the columns on the Invoice.

activeCollab supports a Second Tax on Invoices. Open Administration > Invoice Settings to enable the second tax and optionally mark it as a Compound Tax (for Canada, Quebec and Prince Edward Island).